Photo courtesy of Bloomberg

The principal problem faced by people due to the economic crisis is of rising prices while incomes for many remain unchanged. As a result, the poverty rate has doubled from 2021 from 13% to 25%, according to the World Bank.

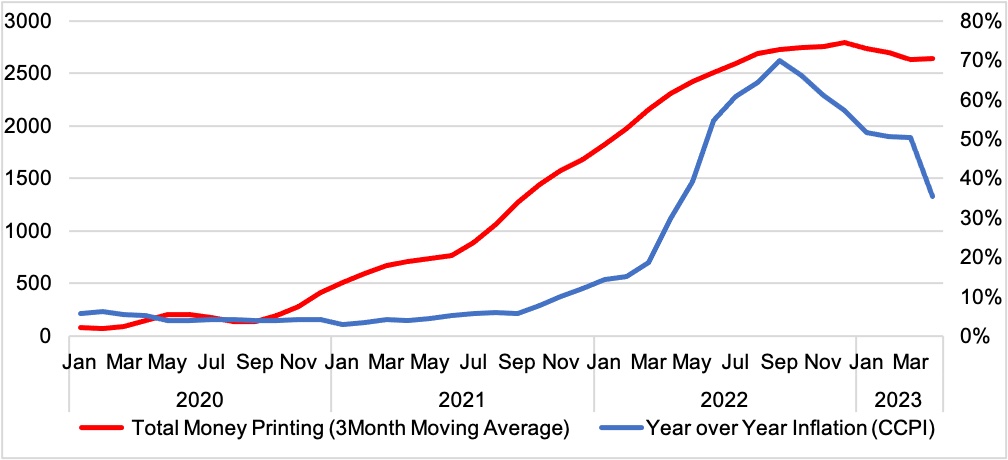

Inflation is a problem worldwide but global inflation in 2022 averaged only 10.1% while Sri Lanka’s inflation was 57.2%, according to the IMF. Global problems have certainly added to Sri Lanka’s woes but external factors cannot explain the dramatic rise in local prices. Local supply chain disruptions did impact prices in 2020/21 but this is no longer a major factor although some effects still linger. What then, were the causes?

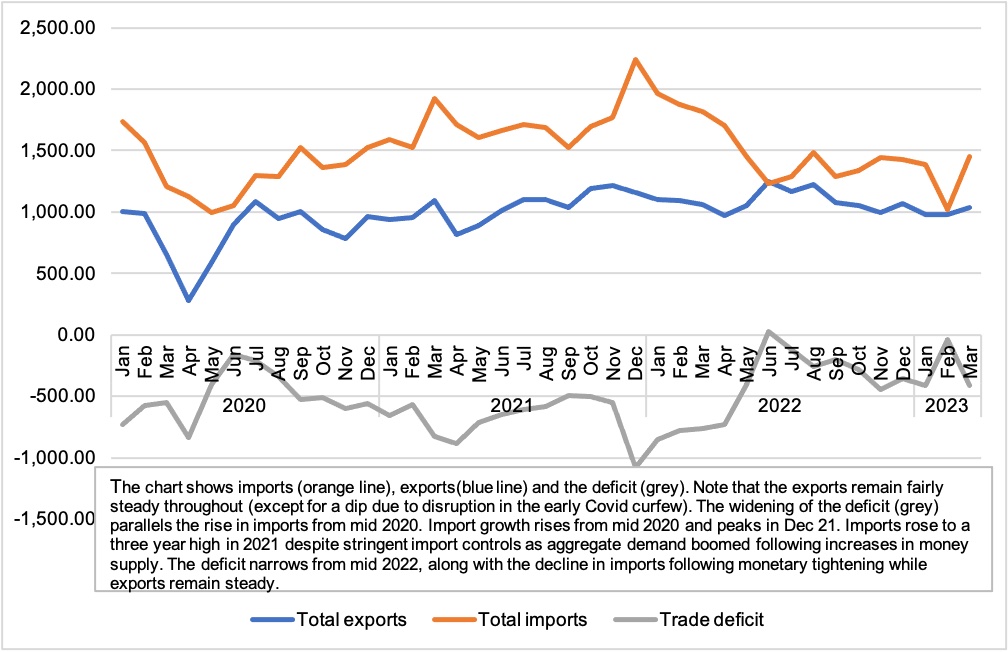

Import restrictions, foreign exchange shortages and currency depreciation have contributed. All of these are connected to the balance of payments therefore understanding the cause of the balance of payments problem is one key to the puzzle. The other key is to identify the cause of demand-pull inflation, which arises from rapid growth in aggregate demand.

These are interconnected and the root of the problem lies the debasement of the currency. This article attempts to explain how the Central Bank’s funding of the government fuels both inflation and the balance of payments problem. Debasing the currency also results in distributional consequences, the painful effects of which are now being experienced.

Balance of payments

The trade flows – imports and exports that appear in the balance of payments statistics – do not exist in isolation; they are a function of the overall demand and supply within the economy. Trade flows are directly affected by decisions of consumption and savings that are made by citizens and the government. Spending by individual or businesses is limited by their income or what they can borrow. If they chose to borrow, the funds they use represent the savings of others. The financial sector mediates between savers and borrowers but what is borrowed is limited to what is saved so no imbalance can occur.

The actions of government, because of sheer size, have a major impact on overall demand and savings; this is the rationale for stimulus spending but it can also create imbalances. If the government is spending less than it collects it is a net saver and no imbalance arises. If it spends more than it collects it is a net dis-saver (or borrower). If the dis-saving is financed by the Central Bank it causes an imbalance that affects the balance of payments and inflation.

Public finances: taxes, debt and money printing

The government has three avenues to finance its expenditure: taxes, debt and credit from the Central Bank (money printing). If government revenues cover its expenditure public finances are sustainable. When a government runs a deficit it can cover this by borrowing. As long as the borrowing is from the market it does not cause an imbalance but the problem is that it tends to bid up the rates of interest in the market. However if the borrowing is from the Central Bank there is no pressure on interest rates which makes it an attractive option.

Money printing, inflation and the balance of payments

Unlike commercial banks the Central Bank does not accept deposits or raise funds from the market yet somehow finances government. This sleight-of-hand is accomplished through accounting entries in the banking system. When the Central Bank buys government securities instead of paying for these by a transfer of funds it simply passes an accounting entry crediting the account of the Treasury and debiting the Central Bank’s holding of government securities. This is new money created out of thin air with no underlying economic activity. This is the source of the imbalance; if the quantum small then the effects can pass unnoticed but if it is large problems are inevitable.

The account of the Treasury is used to make cashless interbank payments for government salaries, pensions, interest and for various goods and services. The money thus spent is received in the hands of people who then use it for their own expenses. The new money starts to circulate in the economy but a problem exists – the quantity of goods and services has not changed.

Greater quantities of money are being spent on the same quantity of goods and services. Depending on the quantities printed, over time this leads to rising prices but critically the changes that take places in prices are not uniform. This has important distributional effects. It also causes the balance of payments problem.

When people spend the new money they do not spend money solely on domestic goods; they also buy imported goods. Moreover many domestic goods use imported inputs. Therefore even if people spend newly created money on purely domestic goods it will create demand for the imported inputs. For example domestically produced rice will use imported fertiliser, pesticides and other inputs so an increase in demand for domestic rice will eventually lead an increase in demand for the imported inputs. Therefore not only does the money printing drive inflation it also drives imports directly when people consume imported goods and indirectly via the demand for imported inputs by local producers.

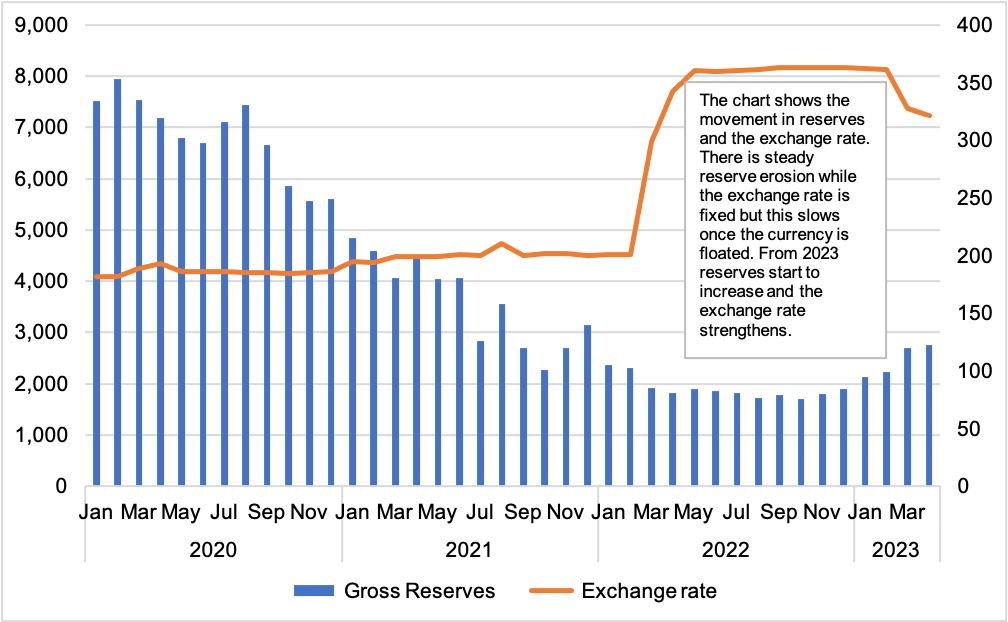

If the demand for imports starts to increase and the increase is persistent, then the demand for foreign exchange will grow. This brings pressure on the currency to depreciate. If the currency depreciates then this brings foreign exchange market back into balance. Imports become more expensive, people consume less and the demand for imports eases and the pressure on the currency disappears.

However if the government tries to control or fix the rate of exchange artificially, then the demand for imports continues unabated and foreign exchange starts to become scarce. A balance of payments problem is born[1].

This, in a nutshell, is the problem. To understand how this has affected people we need to understand the nature of the economy and the role that prices play.

What is the economy?

The economy is made up of the sum of the millions and millions of transactions made every day by people, wherever money is involved. What consumers buy in turn leads to a multitude of decisions taken by thousands of people responsible for producing goods and services: businesspeople, manufacturers, farmers, merchants and hoteliers and all others. They erect buildings, buy machinery, hire workers, develop marketing campaigns based on the prices for which they can sell their goods or services and the costs of obtaining the labour and inputs used in production.

It is a vast and multi-layered entity made up of an extremely delicate and complex web of relationships that are coordinated and held together by prices. It also very dynamic, constantly changing with people’s behaviour which makes it very hard to predict or control.

How did Sri Lanka stumble into this crisis?

Starting in December 2019 and continuing until mid 2022 the government increased spending. For example some 100,000 new jobs were created. It also cut taxes. With increased expenditure and reduced income the budget deficit grew rapidly. It financed much of this spending and even the rollover of its domestic debt through credit from the Central Bank. The Central Bank simply kept bidding at low rates and buying government securities. Interest rates fell to record lows and for a while the economy boomed. The monetary base expanded by 49% between 2020 to 2022 creating a massive shock to the economy.

Distributional effects of an injection of new money into the economy

The monetary shock does not create an immediate or uniform change in prices. Instead the shock percolates through the economy, affecting some prices first, others later while some may remain unaffected. Prices of consumer items will change faster although again not all are affected equally as it depends on spending patterns but the prices of commercial goods, where the demand is derived from consumer goods, will rise more slowly. Among commercial goods, prices of raw materials and components to production process may rise faster than that of factors of production – land, capital assets and labour. Prices of anything on fixed contracts such as wages and rents will change much more slowly. For prices of the factors of production to change the production processes themselves need to change but this changes only in the long term.

Gradually, the new money ripples through the economy, raising demand and prices as it goes. Income and wealth are redistributed to those who receive the new money early in the process (i.e. before prices rise) at the expense of those who receive the new money late in the day (when prices have risen) and of those on fixed incomes who receive no new money at all.

Two types of shifts in relative prices occur as the result of this increase in money: the redistribution from late receivers to early receivers that occurs during the inflation process and the permanent shifts in wealth and income that continue even after the effects of the increase in the money supply have worked themselves out. When a new equilibrium eventually emerges it will reflect a changed pattern of wealth, income and demand resulting from the changes during the intervening inflationary process. For example, the fixed income groups permanently lose in relative wealth and income.

The alternate reality: developments between 2020 to 2022

Between 2020 to 2022 while the purchasing power of money fell, the government disguised the obvious symptoms through price controls (to fix rising prices), exchange rate and import controls (to fix the currency and foreign exchange shortages) and a multitude of others.

These controls did not ultimately work; the problem continued but the restrictions kept the economy tied in knots and masked the most obvious symptoms. A divergence emerged between official prices and reality. As the volumes of money creation grew the divergence widened and the economy entered a phantom state where prices were fixed but goods were not available.

The shortages and queues simply reflected the divergence between the real and nominal buying power of the rupee. The prices of gas and fuel are officially fixed but not enough is available at that price. The same is true for electricity; power cuts indicate the gap between demand and supply. It is the government that was supplying energy but since it depended on imported inputs it could no longer buy sufficient quantities because the rupees it collects from customers bought fewer dollars. The same is true of foreign exchange where the official rate was Rs. 200 but little or nothing was available.

Although the reserves were running out currency swaps and bailouts from friendly countries kept the illusion going for a while longer. Life continued in this twilight zone but reality eventually dawned when no further imports were possible.

Waking up to reality: addressing the imbalances

The government had suppressed many of the visible symptoms of the problem; the controls and regulations that did so hindered some of the normal adjustment that would take place over time in response to increased money creation.

Addressing the problem meant that the huge imbalances that had built up had to be unwound. Fundamentally what had happened is that the currency has been debased, its real purchasing power has diminished greatly. The first step to adjust to the grim reality is to devalue the currency to reflect its real value in the foreign exchange market. Then all prices within the economy needed to adjust to the realistic value of the rupee. As the adjustments needed are huge they deliver a massive, dislocating shock. This is the pain that people are experiencing.

All economic relations within the economy are governed and coordinated by prices. Prices are expressed in money. As long as the value of money remains stable prices will coordinate this complex set of interactions.

A sudden change in the value of the rupee, especially when that change is large, disorders all economic relations. The very foundation of the economy is lost; the entire economy must now adjust to the new value of the rupee that is what is taking place now.

Returning to reality

The measures put in place since 2022 are designed to address the root causes. The imbalances become visible in the foreign exchange market but the causes lie elsewhere in the public finances and monetary policy. In short, the government needs to balance its budget, stop using Central Bank credit and use other sources of funding. Therefore it must raise taxes, cut expenditure and borrow from the market instead of the Central Bank.

How is the problem to be fixed?

The starting point is to restore the currency to a realistic value. The devaluation of the currency is needed to readjust its value to account for all the new money that has been created over the cycle of the boom.

The government then needs to borrow in the market instead of printing, which is why interest rates on treasury bills are hovering around 30% from 6% to 7% in 2021 and taxes have been raised.

It can also reduce expenditure but since much of it is spent on salaries and pensions it will seek other avenues. Fuel and energy were being sold below cost, more so once the currency depreciated so electricity, fuel, gas and water prices have been raised. Costs include the costs of waste, corruption and inefficiency that take place within those entities which is why the government needs to restructure these so costs can be reduced then the savings can be passed on to consumers. Debt is being restructured to reduce interest payments. Losses in state enterprises that add to government expenditure need to be reduced, hence the need for State Owned Enterprise restructuring.

Over the last year as these measures have been implemented shortages have reduced, the balance of trade in goods and services is in surplus, the Central Bank is now acquiring foreign reserves, the rupee has started to strengthen and the rate of inflation has started to fall.

The importance growth

Putting public finances in order brings macroeconomic stability such as stable exchange rates, lower inflation and restores the balance of payments. These have slowed the speed of decline, people are not getting poorer as fast. It has stopped things from getting much worse but cannot address the distributional consequences of the fall in the value of money.

To restore lost wealth requires restoring sustained economic growth, not a temporary boom based on an artificial stimulus. Since 2004 successive governments have tried to increase growth through stimulus such as state spending and capital expenditure, which achieved short term improvements in GDP. The current state of public finances renders this impossible as the government cannot spend or borrow more.

Sustainable growth must be based on improved productivity. Growth comes about when activity increases in in sectors with higher productivity at the expense of sectors with lower productivity in the economy. As a result of the changes in relative prices some businesses will no longer be viable, they may need to downsize or close down; meanwhile new opportunities can emerge based on new patterns of consumption.

Therefore the processes of production must also change. The structure of the economy is changing and the government needs to facilitate this. Investment is needed to create jobs; the government cannot function as employer of last resort and keep recruiting people and borrowing or printing to pay them. Resources in the economy need to be reallocated from lower productivity to higher productivity activities so laws and regulations that hinder the reallocation of resources must be reformed.

Bankruptcy procedures must be streamlined to allow firms to exit and for debts to be recovered. Prudential regulation needs to be strengthened to prevent a wave of bad debt destabilising the banks. For firms that are not unviable but need to downsize or restructure, labour regulations need to be reformed to speed this process. To create new jobs regulations and licenses that hinder new investment need to be reviewed including restrictions on land ownership and use to allow different crops or activities to take place on former agricultural land.

The danger ahead

People may have expected immediate relief with reforms but unfortunately the higher taxes, higher energy prices and currency depreciation paradoxically increased the burden on people, sparking popular anger. Unfortunately the bitter medicine is necessary and can only deliver benefits in the long term.

There is a clear lack of understanding of the fundamentals of the problem both among politicians and the public. Various political parties are attempting to capitalise on public anger; there is a search for scapegoats and conspiracy theories are in circulation. Populist policies – simplistic solutions to complex problems – are on offer from various quarters. Unfortunately there are no quick or easy solutions; there is only a long and rocky path that must be traversed to put the country back on a path of growth.

The danger is that an angry population could vote in parties that abandon the reforms and the pursue the various short term unorthodox policies. This would be a grave mistake since the problems of today are the result of harebrained unorthodox, homegrown alternative solutions. The economy is stabilising slowly but the recovery is far from secure. A few missteps is all it will take for things to quickly become much worse.

The problems of Sri Lanka are self-inflicted, people are paying a heavy price for past errors and while things still bad, with the right reforms incomes can grow again. The public, policymakers and would-be policymakers need to learn from the mistakes of the past and avoid the temptation of further quick fixes.

[1]Note: It is possible to maintain a fixed exchange rate without balance of payments problems provided it is consistent with the monetary policy, if money is being printed continuously then a fixed exchange rate cannot be maintained.