Photo courtesy of Nikkei Asia

Economists tell us that Sri Lanka’s economy has stabilised but what does this mean if so many are struggling?

To economists stability means that the imbalances in the economy have been resolved. The symptoms of the imbalances appear as rising prices, shortages of foreign exchange and goods. These have indeed disappeared but what does it mean to ordinary people? It only means that the rate at which people were being impoverished has slowed. We were crashing down the mountainside but the fall has been broken, if only temporarily. This is no mean achievement but obviously people expect much better.

People enjoyed a particular standard of living in 2020 but three short years later find themselves pauperised and cannot fathom why. What caused this steep decline in living standards? Corruption, poor governance and weak public finances are blamed but these were prevalent for decades. Why did the effects of these pass unnoticed for so long and how did they suddenly manifest?

The fact is that while these are connected to the problem they not the immediate causes. To understand the causes of poverty today we must understand what changed between 2020-2023.

There are two distinct causes but the sake of clarity they must be dealt with separately.

Between December 2019-August 2022 the Central Bank printed huge volumes of money – net Central Bank credit to government grew ten-fold from 363 billion to 3,162 billion. The end result of the increase in the supply of money is the fall in its value. This is reflected in rising prices and depreciation of the rupee in the foreign exchange market.

The government at the time tried to mask the symptoms of the problem by imposing price controls; the exchange rate for the rupee was fixed at Rs.200 along with the prices of many other goods. The result was scarcities of foreign exchange and of goods which were visible in the long queues and in power cuts. As the printing continued, the government imposed ever tighter import and price controls until eventually economic activity ground to a near halt. People were either standing in queues or sitting in the dark. Work in factories and offices stopped because of the unavailability of materials, the inability to transport staff or products and the lack of power.

To resolve this problem the only option was to allow interest rates to rise to slow the credit growth that was fuelling excess demand. A partial devaluation was initially at attempted without a significant rate increase but this failed and forex shortages persisted. The corner was turned only when rates were hiked significantly and a peg re-established at Rs.360.

As the rupee fell all prices rose. Price controls had to be removed, most importantly on energy – fuel, electricity and cooking gas to reflect the diminished value of the currency. This explains the sudden increase in prices of both goods and services.

Unfortunately while prices rose people’s incomes and savings did not. People’s living standards are measured not by their income but by what that income can procure. When the value of money falls living standards fall.

How is this to be reversed? The tragedy is that the effects of currency debasement are permanent. Complete reversal requires that stock money to shrink back to the level it was in 2019. This would lead to a massive increase in interest rates, much higher than present. The consequences of this would be widespread business collapse and an economic contraction that would impose even more suffering.

What should be done? The debasement of the currency can only happen through the Central Bank. It must be prevented by rules from ever doing so again.

People mistakenly think that the Central Bank should try to keep interest rates low but the only way in which this can be done is (a) if the government reduces its volume of borrowing, the sheer size of which puts significant upward pressure on rates or (b) if the Central Bank keeps increasing the supply money (money printing) which lowers rates. It is difficult to reduce government spending in the short term, therefore the borrowing will have to continue. This means the only avenue to lower interest rates is money printing which ultimately impoverishes all.

The Central Bank should not engage in activist monetary policy to stimulate the economy. It must not finance the government’s budget deficit and in its role as provider of liquidity to the banking sector it must not become a banking intermediary. Liquidity to the interbank market needs to be purely temporary, based on market rates with an added premium to prevent moral hazard. Central Bank intermediation must not become a substitute for interbank markets and therefore the relative level of costs between the two is crucial.

If the value of the rupee holds it will allow people to try and restore what has been lost. People need to start all over again and through their own efforts try to rebuild their lives.

The second reason for the increase in poverty is the increase in taxes. People who have already suffered terribly because of currency debasement now face another blow when the government appropriates even more of their income and raises the prices of goods through sales based taxes. The government is fixing the problems in its own finances but doing so by passing the buck on to the people.

In the short term some increases in taxes were unavoidable because of the rigidity in government spending, the bulk of which is salaries, pensions and interest. These must be reduced but this takes time. However there is no excuse for making no attempt to cut costs. For example, the high prices of electricity and fuel include the extra costs caused by corruption in fuel purchases, inflated power purchase costs, excess payroll and inefficiency.

Corruption and waste become relevant to the problem of impoverishment when their costs are transferred to citizens through increased taxes, higher prices and poorer quality of services provided by the government. The use of debt and more moderate levels of money printing allowed the government to conceal the real burden of its spending from people for decades.

The public blames the general increases in prices that result from money printing on “profiteering” by traders. Increases in debt have no immediate impact, it is only when it has to be repaid are the consequences felt at which point “rapacious” lenders are blamed.

Citizens who voted emotionally for corrupt populists have awoken from slumber as the costs of past profligacy have finally become apparent.

Because of the ability of the government to disguise the real burden of its activities, in the context of corruption citizens need to have a singular focus on all economic activities of the government. It is government spending rather than taxation that ultimately determines the total burden of government activity on the private sector. They critical question citizens must ask is how far does government spending actually improve the lives of citizens?

The IMF programme aims to reduce the government’s deficit and debt but the approach taken is to increase taxes with no regard to cutting expenditure. There seems to be unquestioned acceptance of the level of public spending, regardless of its quality or nature.

Tax morale – citizens’ willingness to pay taxes – depends on the trust they have in the government and the quality of services they receive. In the modern world a state must earn the right to collect tax. To do so it must treat its citizens fairly. It must be responsive and seen to be addressing needs and improving services. The lack of this was evident in the protests of 2022.

The state fails in the provision of the most fundamental of public goods – those that cannot be provided by private markets: the rule of law and a functioning system of justice. While some useful services are provided in health and education quality is poor. The spending on private tuition, private schools and private healthcare is a testament to this. Corruption is rampant. For example COPE reports show the State Pharmaceuticals Corporation has repeatedly procured substandard drugs, dud software and failed to follow strictures imposed by COPE.

Promises of jobs are a vote winner. Elections have been won, jobs have been created but only now have the public been presented with the bill. A large proportion of taxes are in effect sustaining a patronage system that enables the election of corrupt politicians.

People need to identify clearly the villains in this tragedy; the Central Bank and mis-spending by the government. Public outrage is justified but unless the sources of the problem, the Central Bank and government spending, are correctly identified, the people may well be duped again.

That the rate of impoverishment has slowed will not satisfy the public but do they realise the fragility of this achievement? Politicians are eager to promise quick and painless solutions. The electorate can expect to be subjected to “death by slogan” over the election cycle. A fairer society. End corruption. A brighter future.

Desperate people may clutch at any alternative assuming that things cannot get any worse but they are gravely mistaken. Politicians who do not grasp the problem may trigger another spiral. Criticism of the current approach is needed but people should look for politicians who offer realistic alternatives. How should voters evaluate alternatives?

To avoid another crisis it is vital to maintain monetary stability and fiscal prudence. Serious politicians must commit to both. Ambitious manifestos must be seen to translate into pragmatic programmes within the fiscal constraint. The British tradition of access talks, pre-election talks between opposition politicians and civil servants, helps to prepare the opposition for government. They need to decide on policy priorities and the mechanics of delivery. Opposition parties who have done their homework will demonstrate familiarity with the limitations of the public finances.

Some talk of billions in stolen assets and imply that all it takes is to recover this and all will be well. Have they examined the complexity of the legal proceedings in the recovery of stolen assets? The international record of successful of stolen asset recovery is poor. The Stolen Asset Recovery (StAR) Initiative, a partnership between the World Bank and the United Nations Office on Drugs and Crime (UNODC), has over 15 years recovered a total of around $1.9 billion. The most successful has been the Philippines which recovered more than U$1 billion over 21 years. This is a tidy sum but do those who tout this as a solution understand the gargantuan size of the government expenditure?

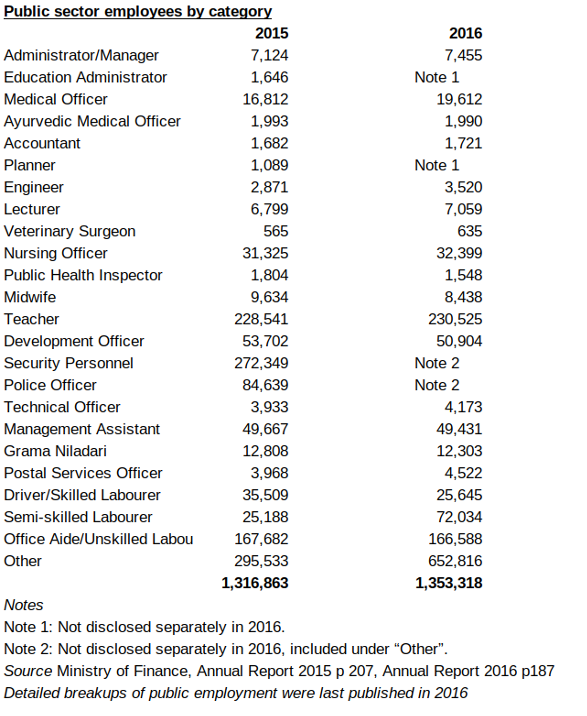

Public salaries cost Rs.956.2 billion in 2022. This works out to Rs.2.62 billion per day. Subsidies cost another 1,020 billion or Rs.2.23 billion per day. Including interest total recurrent expenditure runs at Rs.9.64 billion a day.

The sum total recovered under the StAR over fifteen years would only cover the public sector salaries for a little over seven months and total recurrent expenditure for only two. In any case can a realistic budget be built on such an uncertain stream of revenues? Can the rich pay for this all? How many billionaires and millionaires does the government need to find to sustain spending at a rate of Rs.9.6 billion per day?

Government spending can create the opportunities for corruption affecting not just the level of public expenditure but also its composition, favouring projects that enable the collection of bribes.

If the misspending in the public sector were reduced greatly then the tax burden could be reduced. Salaries and pensions for the 1.5 million employees of public sector and the 672,000 pensioners made up 36% of recurrent spending in 2022 (interest took up 44%). This is an ongoing expense that needs to be paid. Do citizens receive valuable public services in return?

The number in public employment stood at 812,472 in 1994 but is now estimated at 1.5 million Was there a proportionate increase in the quality of services that people received? The breakdown of the categories of public employment is revealing.

Voters must think very carefully. Stability may not mean much but if fiscal prudence or monetary stability is lost it will tip the country back into crisis.

The views expressed in this article are those of the author and do not reflect the views of organisations he is affiliated to.