Nadaraja Devakrishnan stumbled on the gravity of the microfinance debt issue purely by chance. He was attempting to begin community gardening in a small village, to respond to rising cases of CKDu in the district. On returning to check the progress of cultivation, he found none, as all the people had been physically and monetarily drained trying to pay back their microfinance loans. Through the People’s Movement for Community Awareness, he has been grappling with the predatory practices of microfinance companies on villagers in Vavuniya for the last few years.

“The way the microfinance companies are treating people is as much a violation of human rights as enforced disappearances, or things done to people under the Prevention of Terrorism Act” he says to a group of women who have come together to share their struggles, and to think of ways to respond to agents of these companies, who harass them for repayment.

“In the immediate aftermath of the war, there were about 3 or 4 microfinance companies working in the North, but after the government changed in 2015, there are about 34 operating now, including companies run by prominent politicians.”

Cascading loans and predatory repayment tactics

As of March 28 2019, around 170 people are reported to have taken their own lives after being unable to meet debt repayments. In 2018 alone, 15 people in Vavuniya and 55 people around the Province have taken their own lives as a direct result of this crippling debt, says Devakrishnan. He works with several women whose lives have been altered by these companies, and details the immense pressure placed on them for repayment. “They come and harass the women in the house, ask them to sleep with them, take away possessions from the home, and refuse to leave unless they are given the money.”

*Meenakumari and her husband wanted to build a grinding mill, much like the one he had worked in as a child, to operate as a source of income. After a few years of seeking support from microfinance companies to support this dream, she now has ten loans to her name.

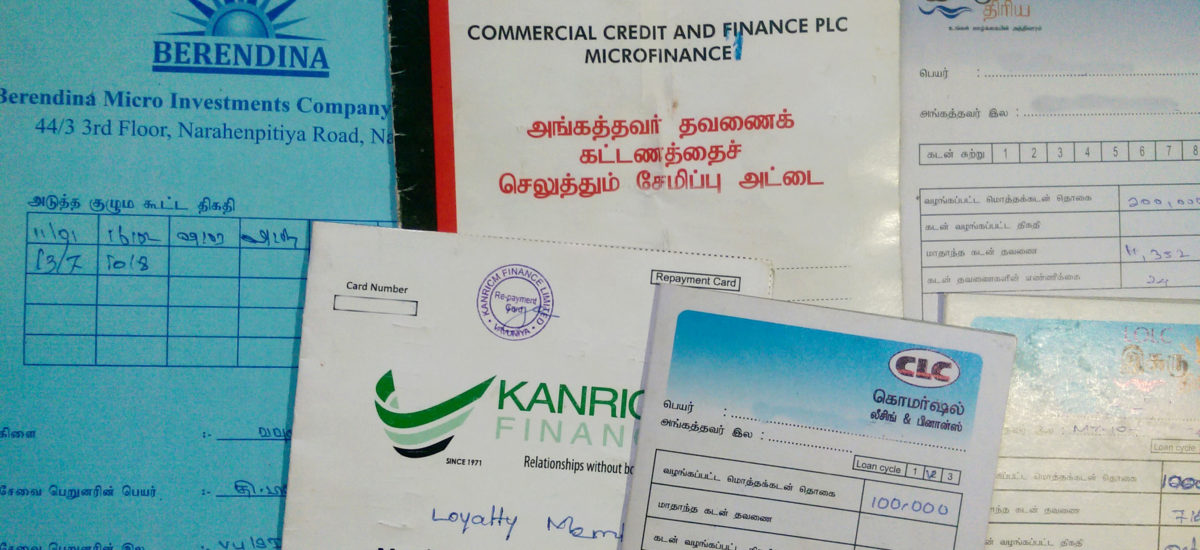

“Berendina, Ceylinco Leasing Company, Vision Fund Lanka, LOLC, Commercial Leasing, Kanrich, MBSL, Nation Lanka and HNB Grameen”, she counts off on her fingers.

Her first loan, for Rs. 50,000, was from Berendina, and she paid a monthly instalment of Rs. 4,800 for one year. In order to complete the next phase of their building, they took a loan of Rs. 100,000, paying Rs. 4,600 weekly. Their current loan, from HNB Grameen, is for Rs. 200,000, with a weekly payment of Rs. 3,900 due. It is this loan that has sent Meenakumari and her husband spiralling into debt.

The grinding mill brings in only a limited income of around Rs. 5,000 a month. The price of goods produced at home is higher than those of mass-produced spices and flour that people can buy at a store. For this reason, they are forced to price their goods lower, and this severely impacts their ability to repay their loans.

They took two more loans to settle the borrowing of Rs. 200,000. However they find the largest chunk of their money goes towards settling what are called ‘metre loans’. These are informal agreements with the credit agent,that requires a daily interest payment. Meenakumari has a total of 7 metre loans that she is now paying off.

*Madhavi is the mother of two young girls. One day, her neighbour left their house to hide, fearing a credit agent who was due to collect a payment. The agent refused to believe Madhavi’s explanation that the person was in hospital, and loitered around the house. Madhavi was then forced to ask some money from the nearby shop and pay the agent on behalf of her neighbour.

Her house now functions as a loan centre for Vision Fund Lanka, set up by the company to operate locally within small villages. From here, they give out and accept applications, take payments and supply information. There is no written acknowledgement however that Madhavi’s house is being used for this purpose. She acts as the loan centre leader, again a role that has no written confirmation. When asked what happens if people borrowing through her centre are unable to repay, she says “the leader has to find the money and pay the agent, somehow”.

Sajee, who acts a centre leader in her village, says that the agents do supply a lot of information to borrowers. They explain forms, interest and repayment to the villagers clearly. While there is a policy that loans need to be income-generating, the agent never checks on this, to account for the strain on the borrower if this is not so.

She lists the documents necessary to obtain a loan. Copies of one’s NIC and for women, a copy of one’s husband’s NIC, a family card, issued by the local grama sevaka, and a note of income and expense. There are some issues with these documents. Family cards are not regularly updated, and might not account for any children born since the time of issuance. Since the income is a self-declaration, and requires no certification, people often increase the value to better their chances of getting a loan, but also distorting the agent’s perception of their ability to repay the loan.

They are required to send all this in an envelope with a Rs. 50 stamp. Also required is a signed copy of a slip, provided by the agent that can be produced in court if they cannot repay the loan. The information is filled in by the agent should the need arise. Alarmingly, the women note that they sign on a blank document when submitting it.

*Shanthini, who has taken loans through the centre Sajee leads, says that the agent does not keep track of individual loans, and the strain placed on them by multiple companies. “Unless we’ve taken loans from a particular agent before, the rest of our loans don’t register on any of the records. Many people do not disclose this to lenders as they apply for new loans either.”

She explains the schemes for loans from Vision Fund Lanka, a subsidiary of World Vision. An education loan of Rs. 15,000 can be paid in December, to prepare for the child’s new year in school. Rs. 150,000, with a monthly interest payment of Rs. 54,000, is the value of a housing loan. Finally, their ‘Saviya’ loans give Rs. 100,000 to individuals wanting to start small businesses in their homes. Monthly payments for each of these loans are Rs. 15,000, Rs. 8,600 and Rs. 7350 respectively.

If an agents thinks that a particular borrower is able to make regular repayments of their loan, they extend their housing loan to as high as Rs. 500,000. However, if a borrower signs on to this extension, they allow the agent to take the deed or permit of their house as collateral for non-repayment.

LOLC has a similar policy, where personal loans of Rs. 500,000 must carry signatures of two guarantors who are government servants, and require house documents as collateral. Lawyer Lakmali Hemachandra, who is working on relief for these women, notes that this is possibly just a tactic of intimidation. “Given that a lot of the land in the North, after release, is state land, residents would only have a permit. Permits cannot be transferred between individuals, so it is unsure what they plan to do when the deed is surrendered, or if they can do anything with the land. It’s probably just to make people more fearful and dependent on their support.”

The women say there are people who have left the country to escape being choked by these loans. Due to the harassment and threats meted out by agents, it falls on others to pay what is left. The prevailing drought has compounded the uncertainty and strain on these individuals and their families – it impacts the gains that could be made from agriculture. Existing employment options are limited, and loans do little to alleviate the burden.

Community and legal relief

Community organisations are doing their best to provide some relief for the people. This begins with debt mediation boards, where a compromise is reached to reduce the loan amount. Prashan, leader of a Rural Development Society, says that he refused loan agents entry into the village one day, so they would not harass people who could not pay that month. In some villages, men have even physically chased away agents, running after them as they attempt to approach the houses of those struggling with repayment.

Attorney-at-Law Radika Gunaratne is representing several women across the North-Central province in courts, as they file cases against predatory microfinance companies. ‘’Cases should ideally be dealt with at the district courts, but police intervene before legal action is even taken, threatening people to pay. They know where to visit them at home because the companies openly share their details with the police’’. Gunaratne says the cost of such a case, if it is eventually taken to court, once again only serves to trap the person with more expenditure on legal fees.

“The people need a two year grace period” Devakrishnan says “no loans taken, no repayments made, just time to revive the economy and make some money.”

Debt relief programmes and their effectiveness

In July 2018, Finance Minister Mangala Samaraweera presented a paper in Cabinet that proposed to write off loans less than Rs. 100,000 for communities in the North. In addition, the Central Bank proposed to set a cap of 35% on interest rates on these loans. While hailed for their attempts in addressing a crippling issue, there is some hesitation as to the full impact of these measures.

Ministry of Finance officials noted to Groundviews that the 35% cap is only applicable to those firms in the formal economy, and it is those in the informal economy who are inflating borrowing costs with high interest rates. They claim that a rate cap of below 35% is likely to push the formal players out of the industry, creating more space for the informal sector that charges high interest rates from borrowers.

“In my opinion, the debt relief and regulatory measures are not enough to address the debt problem the women are facing”; economist Niyanthini Kadirgamar has a range of reasons to claim so. This begins with the fact that the interest rate cap comes into effect only if companies sign a voluntary Memorandum Of Understanding. Even if they were to comply with the standards therein, then the 35% interest rate cap is still too high. The companies are raking in profits while these women and their families face hardships. “These loans are obtained by very poor women for small self-employment efforts; there is no way they can earn enough incomes to pay off such high interest rates” Kadirgamar says.

Currently, the Government’s debt relief program targets only those who have defaulted payments for three months. Kadirgamar says that this doesn’t take into account the fact that many women somehow try to pay off the loan, often resorting to extreme measures to do so, such as skipping meals for children, selling their land, or taking another loan. The women pay their monthly dues due to pressure and aggressive collection practices adopted by the companies. “I know of women who have gone into hiding to escape the debt collectors”, Kadirgamar says, stressing that the reality is very different from what these companies tend to advertise about microfinance – ‘poverty alleviation’ and ‘women’s empowerment’ are words that have no depth in the way microfinance is affecting families across the Northern province.

She suggests that an effective strategy would be a complete write-off of all the predatory loans. Poor women should not be made to pay unfair interest on their small loans. The UN expert on foreign debt also highlighted that human rights standards must be upheld with micro-credit lending. A moratorium of at least two years would also be helpful for drought-affected areas, until they are able to revive their livelihoods.

The officials claim that debt write-off is not a sustainable policy, and that these debt relief operations were targeted for women especially vulnerable due to the ongoing drought. Comprehensive legislation that will protect consumers, and regulate the steps that microfinance institutions can take to collect repayments, is necessary, and is presently being drafted.

Provisions for relief in the 2019 Budget

The 2019 Budget proposed the Enterprise Sri Lanka loan scheme as an avenue to relieving these individuals from the debt trap. These concessionary loans are primarily for those engaged in the agricultural sector, with no collateral needed to be eligible for it. While the Ministry states the rates are much less than those offered by a microfinance institution, it is nevertheless offering more loans as a remedy for issues that loans have caused.

The Ministry believes that since these loans are given to invest in revenue generating activities, chances are that in the medium- to long-term, households would be able to create sustainable avenues of income that can be used to pay-off previous debt. However, this assumption must be considered alongside the fact that the North, Eastern and North-Central provinces have accounted for the lowest GDP by province in the years 2016 and 2017. In addition, the agricultural sector accounts for the lowest percentage of economic activity in these three provinces. As discussed above, individuals might take loans for cottage industries or agricultural work that does not always generate a high income, and could once again serve to affect repayment. Whether this strategy as it stands will actually translate into sustainable income for the individuals, given the structures and opportunities currently in place in these regions, will only play out in the years ahead.

The Ministry notes that financial literacy is being accelerated by the Central Bank, to educate possible borrowers on the risks of taking loans from the informal sector. However, there is a long road ahead in ensuring that microfinance becomes a sustainable tool to improve lives of the individuals who take these loans, many of whom constitute the most vulnerable segments of the population. Framed as legislation for consumer protection, the new act could result in more responsible lending practices and also lay out consequences for companies or agents who do not adhere to these. If new loans do not act as a solution to the individuals who have suffered deeply as a result of old ones, then it is necessary for moving toward alternative models – such as cooperative credit schemes, as Kadirgamar suggests – that are developed based on what is most beneficial for the community and individuals who need it most.

*Names changed and locations withheld to protect the privacy of the individuals.