Featured image courtesy AFP/GETTY – Rodrigo Arangua

On April 3, 2016, Suddeutsche Zeitung, Germany’s largest daily newspaper leaked 11.5 million files from the database of Mossack Fonseca, a law firm headquartered in Panama City, Panama. The firm is one of the world’s top creators of shell companies, corporate structures that can be used to hide ownership of assets. The files exposed financial dealings of some of the world’s richest and most powerful individuals. The documents included financial records, legal documents such as passports, and correspondences dating back over 40 years ,which reveal offshore accounts of current and former world leaders as well as individuals with close ties to political figures and business moguls around the globe. The files also revealed that it is not only politicians who are found to be tied to the alleged laundering of funds but many celebrities, professional sporting stars and even sporting bodies too. Now that the door is open, new revelations are bound to come forward to expose the depth of the Panamanian corruption scandal. The release of the Panama Papers is thought to be merely ‘Chapter One’ of a much more serious and larger case.

Analysts comment that these findings show how deeply ingrained harmful practices and criminality are in the offshore world and that the release of the leaked documents should prompt governments to seek “concrete sanctions” against jurisdictions and institutions that peddle offshore secrecy. The documents reveal that Mossack Fonseca, far from being an aberration, was an integral part of the operations of leading global banks. As the International Consortium of Investigative Journalists (ICIJ) puts it, “The documents make it clear that major banks are big drivers behind the creation of hard-to-trace companies in the British Virgin Islands, Panama and other offshore havens. The files list nearly 15,600 paper companies that banks set up for clients who want to keep their finances under wraps, including thousands created by international giants UBS and HSBC. This leak is thus proof that despite explicit banking laws against tax evasion, criminal uses and money laundering, the global offshore shell game business remains open for the wealthy and well connected to exploit.”

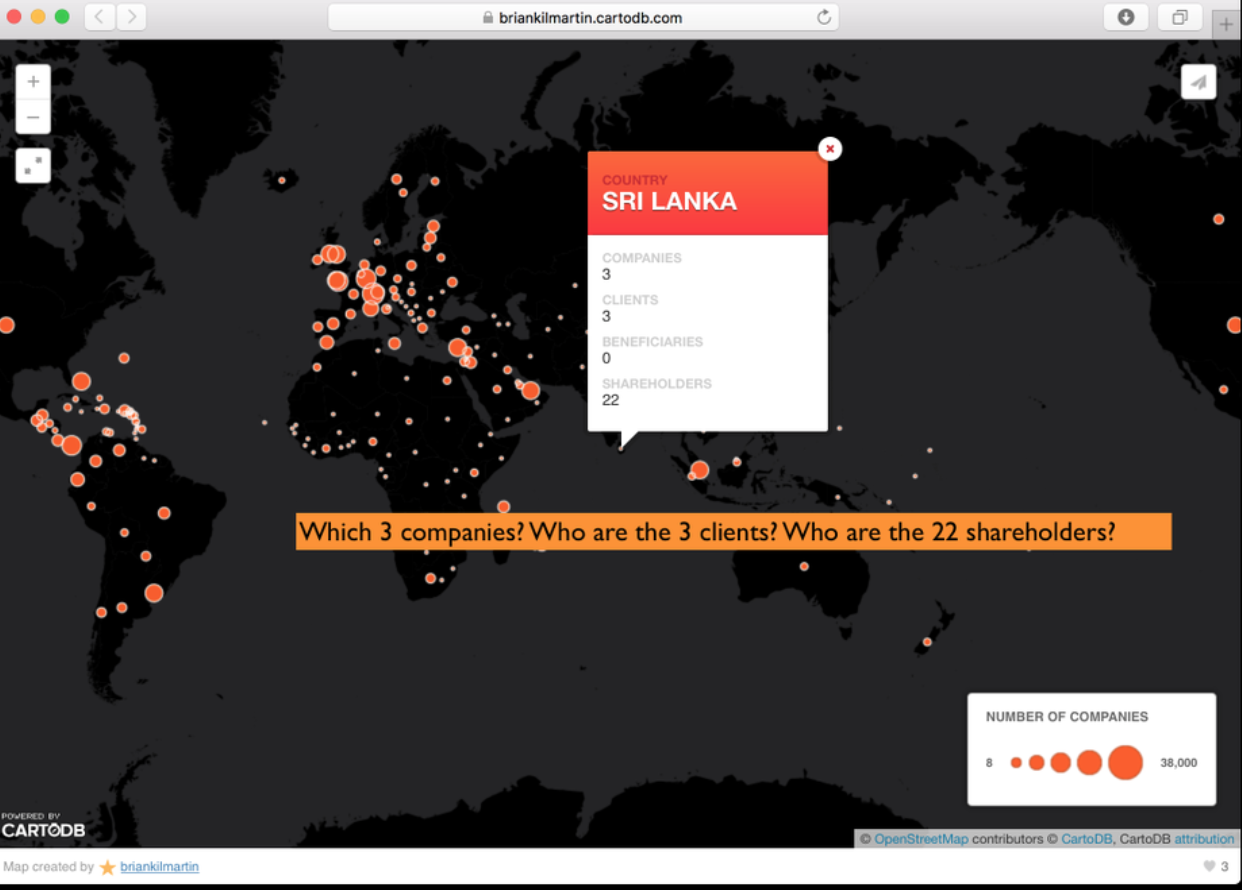

This state of affairs bears much direct relevance to Sri Lanka as well, as the map, published by the Irish Times, titled as ‘secret companies around the world’ indicates that there were 3 Sri Lankan companies too which were listed in the report with 3 clients and 22 shareholders.

Therefore, there is direct interest for Sri Lanka to investigate further regarding this exposure about Sri Lankan companies and entities being named in this controversy. The Government should however not just limit their interest to a full detailed exposure of those companies and personalities involved, but also ascertain the extent of the tentacles of corruption and money laundering followed by politicos and businesses in stashing their ‘ill-gotten’ wealth abroad. One of the largest protests in Iceland’s history demanding Prime Minister Sigmundur Gunnlaugsson to step down after the leaked files revealed he and his wife were hiding investments worth millions of dollars behind a secretive offshore company, has much resonance to all of us following political developments in Sri Lanka.

Mangala Samaraweera went on record some time back saying that Sri Lanka had already secured support from four countries to track an estimated USD 18 billion in assets stolen by former president Mahinda Rajapaksa and his family. The US and India had previously announced they were helping Sri Lanka’s new government track down stolen wealth stashed abroad, allegedly hoarded in tax havens.

Yet the start of the Maithripala-Ranil era too smacked of corruption. One prime example was the Central Banks Governor’s alleged shady deal, which dented this Government’s credibility to a great degree. It is therefore vital that the new government too, reads their mandate correctly, as it was the result of the winds of political change which swept through Sri Lanka in 2015. People demanded a clear plan of action to bring in good governance, transparency and accountability; not just small doses of them. Of course, investigative and law enforcement arms such as the Financial Crimes Investigative Division (FCID) and the Commission to Investigate Allegations of Bribery or Corruption (CIABOC) were set up and/or strengthened. It has been a routine daily news bulletin item in the post-January 2015 period, with many parties submitting petitions to the Commission and the Police subsequently arresting and releasing various culprits. These staged dramas, now almost a source of public entertainment rather than showing any significant results, have made the public question whether the ‘Yahapalanaya’ promise to have zero tolerance’ to corruption is merely an eye wash or a serious commitment to clean the stables and ensure a clean political culture.

Of course, there are noticeable improvements in accountability and transparency and press freedom, arming people with knowledge about how political leadership is managing public finances. However, people are quite rightly demanding concrete steps to achieve the ideal of zero tolerance to corruption; not just ‘flash in the pan’ marginal improvements to attract public attention or gain short term cheap political mileage by hunting down political opponents. The public also needs to know about the progress of the government’s drive to track down the nation’s wealth allegedly stashed abroad, which was a major campaigning point during election time.

Sri Lanka was ranked 83rd out of 175 countries, according to the 2015 Corruption Perceptions Index reported by Transparency International. Sri Lanka’s corruption Rank averaged 81.79 from 2002 until 2015, reaching an all-time high of 97 in 2009 and a record low of 52 in 2002. Sri Lanka clearly need to aim for a consistent plan of action to achieve a higher rating on the Anti-Corruption Index of Transparency International (TI).

Black money is basically income from which tax has been evaded and tax havens are territories which provide a safe and easy environment for such money to come in. Such territories are “safe” because neither do they ask the depositors where the money is coming from nor do they share such account information of depositors easily with other countries. It is a known fact that the flow of black money out of a country into tax havens of dubious nature, such as Mossack Fonseca in Panama (reportedly only the third largest in the world and certainly not the only one) can easily destabilise the financial market of a country.

It is developing countries like Sri Lanka that are impacted more due to such capital outflows, hence the need to take immediate and stringent measures to put these practises to an end. It has been estimated that every year, developing countries lose about $160 billion to such tax havens. Adopting urgent measures to curb such an outflow of black money is therefore the need of the hour for Sri Lanka at this crucial point of time, when there is a new government which has much more credibility than the previous one. There is clamour from the public and aspirations are at an all-time high to ensure a clean political culture for Sri Lanka. Besides, it is also important to reform the vital institutions of the judiciary and the law enforcement authorities, particularly the Police, to crack down on corruption and nepotism to regain public credibility . Perhaps, this is an opportune time to reflect on this national priority when constitutional reforms are also on the cards.

Will the Panama papers therefore propel Sri Lanka to go beyond mere verbosity and put their house in order – to take concrete action to bring culprits who have siphoned out public funds abroad to their advantage, to close the legal /financial loopholes and to hold public representatives to account by ensuring accountability and transparency on their part? Only time will tell.

However, in the best interests of future generations, Sri Lankans must insist that their government ‘walk the talk’.